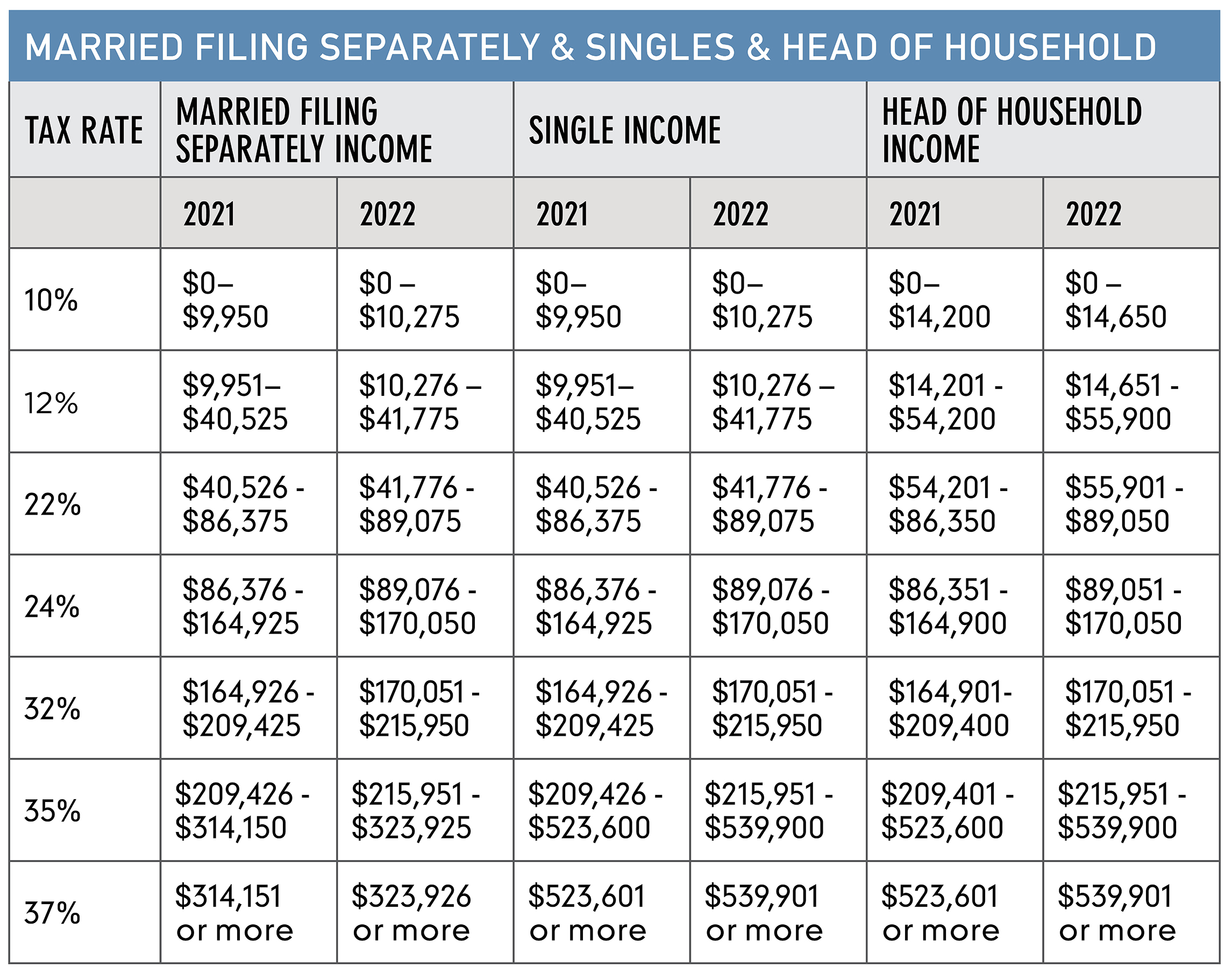

Married Filing Separately Tax Brackets 2025. The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation. The filing status options are to file as single, married filing jointly, married filing separately, head of household, or qualified surviving spouse.

The filing status options are to file as single, married filing jointly, married filing separately, head of household, or qualified surviving spouse.

While the tax code generally favors joint returns, some spouses may benefit from filing apart, experts say.

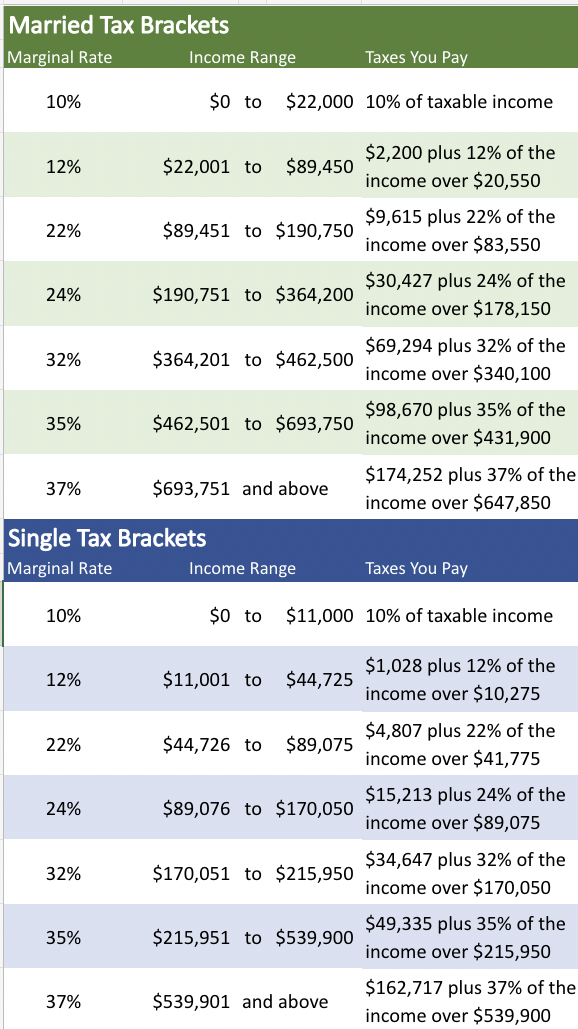

Irs Tax Brackets 2025 Married Jointly Latest News Update, For the 2025 tax year, for example, the 24 percent tax bracket kicks in on income over $95,375 for single taxpayers and $190,751 for married joint filers, with. 28% tax rate applies to income over:.

Cuddy Financial Services's Tax Planning Guide 2025 Tax Planning Guide, File your federal and federal tax returns online. How to track the status of your.

50 Unveiled Benefits of Married Filing Separately Ultimate Guide 2025, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

Tax Brackets 2025 Married Jointly California Myrle Tootsie, How to track the status of your. Last updated 17 days ago.

IRS 2025 Tax Tables, Deductions, & Exemptions — purposeful.finance, For the 2025 tax year, for example, the 24 percent tax bracket kicks in on income over $95,375 for single taxpayers and $190,751 for married joint filers, with. File your federal and federal tax returns online.

Tax Rates Heemer Klein & Company, PLLC, How it works, when to do it. Here’s how that works for a single person earning $58,000 per year:

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, “married filing jointly” combines income,. How to track the status of your.

brackets reveal your tax rate as deadline to file 2025 taxes is, For single filers and married individuals filing separately, it’s $13,850. Find the current tax rates for other filing statuses.

How to Know Whether to File Married Filing Joint or Married Filing, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married. Married filing jointly or qualifying surviving.

2025 Tax Brackets Married Filing Jointly Standard Deduction, When deciding how to file your federal income. For the 2025 tax year, for example, the 24 percent tax bracket kicks in on income over $95,375 for single taxpayers and $190,751 for married joint filers, with.